The 'Father of Options': How Illicit Moneylending via Put-Call Parity Made a Millionaire

A true story of how Russell Sage circumvented 19th century usury laws with financial engineering

Did you know the "Father of Options" circumvented 19th century usury laws via financial engineering to make $?

Let's dive into the fascinating story of how Russell Sage leveraged put-call parity to become a millionaire, and how put-call-LP parity revolutionizes DeFi options🧵

In this thread we'll:

Show how Russell Sage made millions by subverting the law with options

Use monkeys & bananas to explain put-call parity

Explain why "put-call-LP" parity for DeFi options is as groundbreaking as put-call parity was for TradFi options

What's usury?

Usury, aka predatory lending, is charging an excessive rate of interest on a loan.

Historically, usury was defined as charging *any* interest on a loan and was condemned by major religions & prominent philosophers (Moses, Buddha, Muhammad, Aristotle...).

In 1867, Russell Sage was convicted of violating New York usury laws for charging an 8% annual interest rate on a late loan to a stockbroker. The penalty for Russell was $250 in fines and 5 days in prison (source here).

But this didn't deter him. Russell used his know-how of options to create synthetic loans. He developed OTC options trading on such a grand scale that he was known as "The Father of Puts and Calls", inventor of straddles & strangles, and the "Money King".

But how exactly did the "Money King"💰👑 create loans through options trading? The answer lies in a fundamental concept found in every financial textbook called "put-call parity", which can be used to create synthetic loans.

Imagine a seesaw with 4 types of fruit: apples🍏, peaches🍑, cherries🍒, and bananas🍌.

In order to stay balanced, the seesaw must have a fixed ratio of apples🍏 + peaches🍑 on one side, and cherries🍒 + bananas🍌 on the other side.

Each fruit represents a financial instrument, and the fundamental relationship between the fruits is put-call parity.

🍏 = asset price

🍑 = put price

🍌 = bond price

🍒 = call price

Put-call parity: 🍏 + 🍑 = 🍌 + 🍒

"Mon[k]ey King"🐵👑 be like: "Me like loanshark — me want high interest rate!"

Buying 🍌(bonds) is a fancy way of saying: "Me lend you some money in exchange for interest."

→ So 🐵👑 can loanshark by buying 🍌(bonds — in this case, high yield ones)! 🤯

But 🐵👑 couldn't legally buy bananas🍌 (bonds — the high yield ones). 🚩🚩🚩🐵👑⛓️👮

Instead, he:

Bought apples🍏(asset)

Sold cherries🍒 (calls)

Bought peaches🍑 (puts)

→ Effectively purchasing bananas🍌 (bonds) to create loans at higher interest rates than was legal!

Just as "put-call parity" is fundamental to options, "put-call-LP parity" is fundamental to DeFi options.

Panoptic begins w/ the simple observation that providing concentrated liquidity in Uniswap V3 is analogous to selling options in TradFi.

LP = -Put 🤯

Let's call this observation "put-LP parity": LP = -Put (🍋 = -🍑)

Which means: -LP = Put (-🍋 = 🍑)

→ Panoptic lets you buy peaches 🍑 (puts) by selling lemons 🍋 (LPs) 🤯

How do you buy 🍒 (calls)? Answer: lab-grown synthetics!

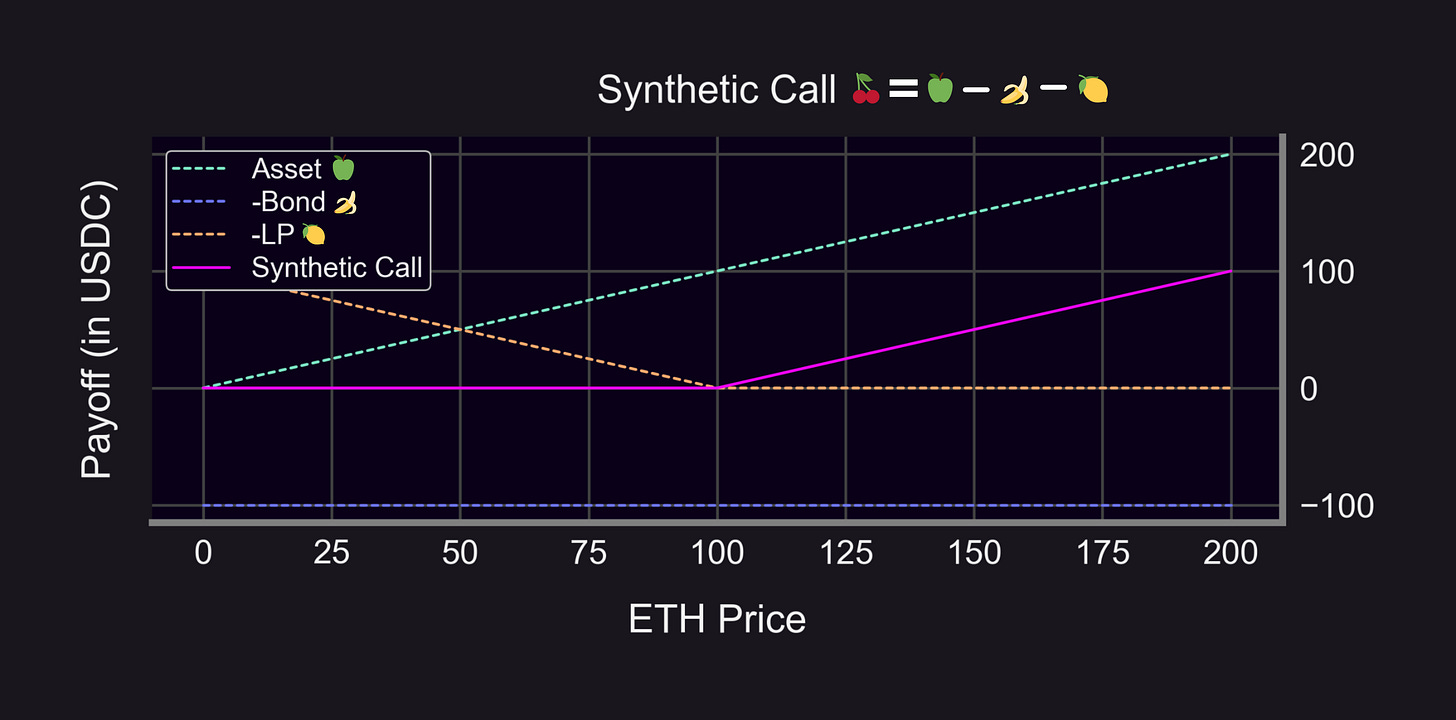

Put-call parity: 🍒 = 🍏 - 🍌 + 🍑

Put-LP parity: 🍑 = -🍋

→ Combined: 🍒 = 🍏 - 🍌 - 🍋

→ You can buy 🍒 (calls) by buying 🍏 (asset), selling 🍌(bonds), and selling 🍋 (LPs)🤯

Panoptic Labs™ synthesized a new type of 🍑 and 🍒: These 🍑 and 🍒 are shelf stable because they NEVER expire!

Panoptions are a novel type of options:

Perpetual♾️

Oracle-free🔮

Permissionless🤠

Made for DeFi🔑

Summary:

Put-call parity describes the relationship b/t puts and calls

Russell Sage took advantage of this to make high interest loans

Put-call-LP parity describes the relationship b/t put, calls, & LP

Disclaimer:

📢 None of this should be taken as financial advice