Stablepools Are Boring? You're Wrong.

Exploring stablecoin pools on Uniswap v3 - price, volatility, correlation, and more...

Someone told us that stablecoin pools were boring😬🤯 Here's why they're wrong!👇

For starters, around 1B out of 3.7B TVL in Uni v3 is a stablecoin pool. That's around 27%! Of that 1B, about half of it (0.45B) is concentrated in the DAI-USDC pools at 0.01% and 0.05%. But it's not just about size. Let's dig deeper into some of these pools.

We investigate the following UniV3 pools:

USDC-USDT (0.01%)

USDC-USDT (0.05%)

USDC-DAI (0.01%)

USDC-DAI (0.05%)

FRAX-USDC (0.05%)

(Psst! See 👇 for a tutorial on obtaining pool data using Python and GBQ 😉)

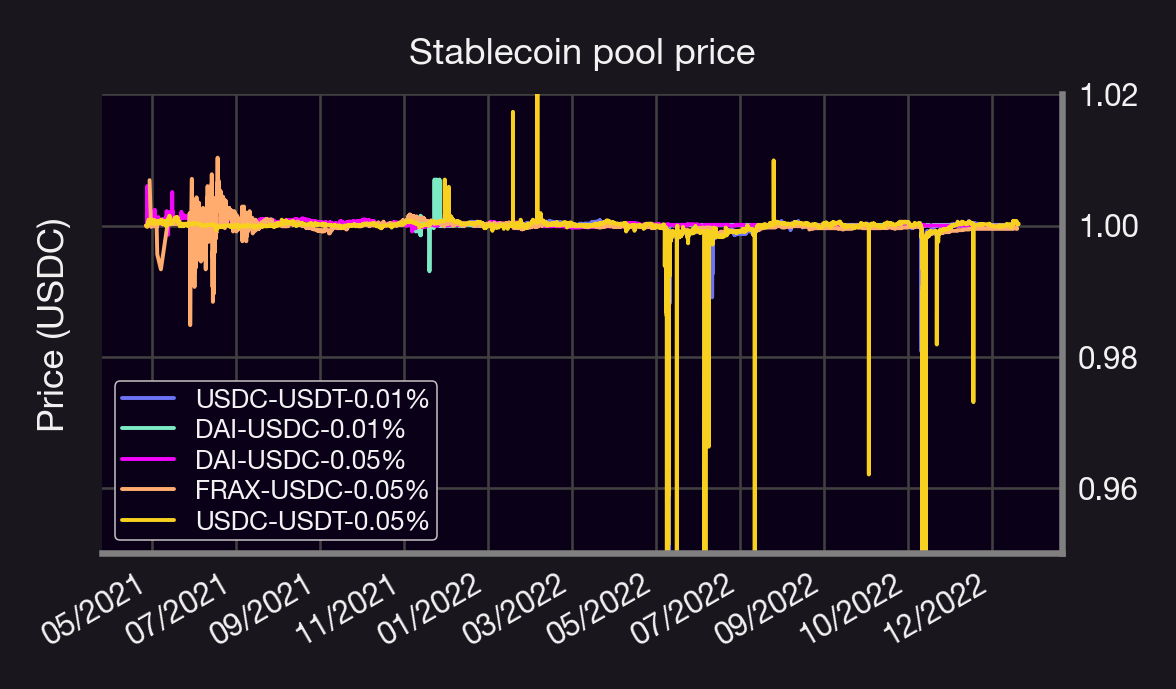

Let's start by looking at prices. They should be super stable...right?

Mostly! Some stable pools are more stable than others 🐷🏠

Some pools exhibit short periods of large variability, likely due to whales + MEV + UniV3 liquidity math (e.g. USDC-USDT 0.05%)

Remark: The prices 👆 are ordered on a "per-tx" basis; thus, some of the larger spikes happen inside the same block as their neighboring transactions.

Some pool stats:

Most stable: DAI-USDC (0.01%)

Most popular: USDC-USDT (0.01%)

Largest volatility: USDC-USDT (0.05%)

~Log-normal distribution of txs (eyeballing it)

See histograms + summary statistics👇

(Note: here ~ means "approximately")

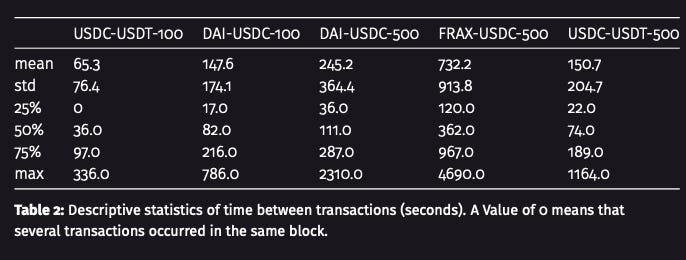

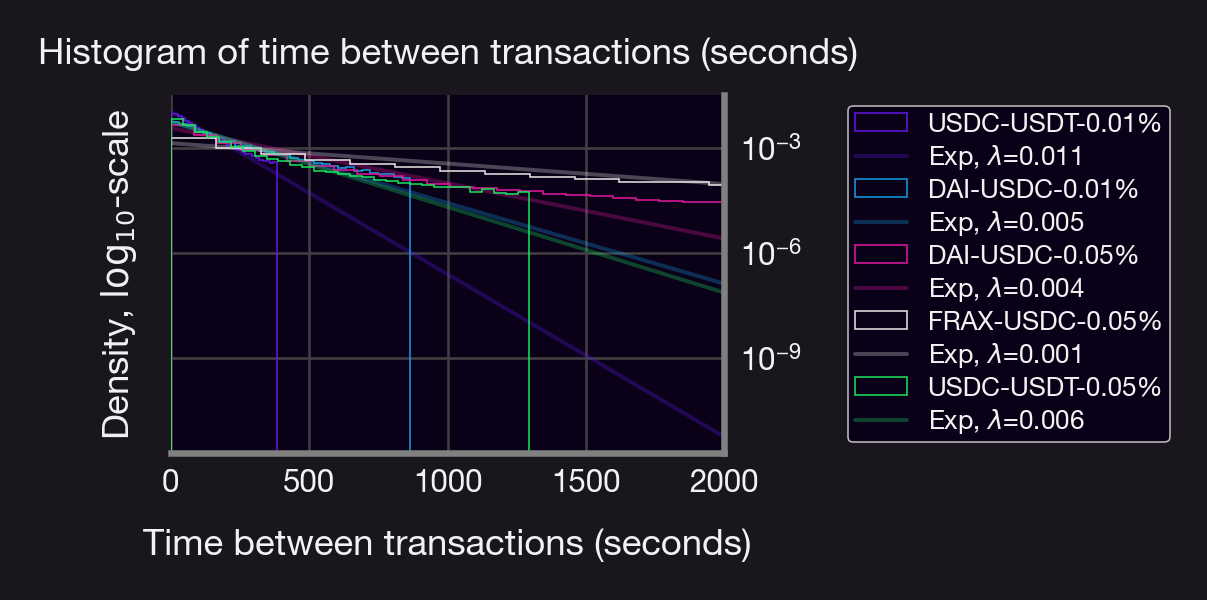

What about time between txs?

USDC-USDT (0.01%) is the busiest pool (~1 tx/min on avg)

FRAX-USDC (0.05%) is the quietest pool

Each distribution resembles a geometric (and hence exponential) distribution with a given parameter λ (but with fatter tails)

See figs👇

Now let's examine price correlation b/t pools:

Since txs occur at irregular intervals, we take the avg price over 5 minute intervals

Not all are as strongly correlated as one would think 🤔

High correlation b/t USDC-{USDT,FRAX} pools

Low correlation for DAI pairs

Key insights:

Per tx price is less stable than one would think!

There is, on average, ~1 tx every 5 minutes across all pools

Tx amount ~log-normal; time between txs ~exponential

Price across some pools are weakly correlated, with Dai being the odd one out

Why is this important?

Understanding the behavior of stablecoin pools can help us model them (e.g. for forward testing); can't use GBM

Understanding correlations b/t pools can help us develop beta-trading strategies (e.g. stat-arb) (👆topics of future #ResearchBites)

Why can't we use GBM? Intuitively, stablecoins should:

Oscillate around 1 (e.g., USDC)

Have bounded variation (not stable otherwise)

Whereas for GBM:

Price either becomes unbounded (µ>0) or goes to 0 (µ<0) in expectation

Variance increases with time 👇🤓

Indeed, let S denote an asset with price process {S}. Furthermore, let μ denote the drift parameter of the price process and σ>0 its volatility, and let W denote the standard Wienner process. We say that {S} follows a Geometric Brownian motion (GBM) if {S} satisfies the following stochastic differential equation:

Furthermore, given an initial price S0, it follows from Ito’s lemma that

Which in turn implies that its mean and variance are given by:

which, as we can see, increase as t increases! This is clearly not the case for stable coins.

Disclaimer: This content is for educational purposes only and should not be relied upon as financial advice. Please DYOR!