Optimal LP Width in Bull/Bear Markets

We simulated LP performance on the ETH-USDC 0.3% pool. Here's what did best.

We analyzed simulated LP performance on ETH-USDC 0.3% pool.

Results were surprising: 📢 The optimal width was wider than expected.

What's the optimal width for max returns?

How does that change for 🐂 vs 🐻 markets?

Find out 👇

The strategy is simple:

💦 LP around the current ETH price with ±X% width

⚖️ Rebalance your LP position after a day, week, or month (you pick)

💵 Collect & compound your fees!

Our analysis includes >1.5 years of data (Jun 2021 - Jan 2023)

On 5 different range factors:

±5% (r = 1.05)

±20% (r = 1.2)

±50% (r = 1.5)

±75% (r = 1.75)

∞ (UniV2 full-range, r = 1000)

Which one did best?🤔

For the FULL period (Jun 2021 - Jan 2023):

Daily rebalancing: r* = ∞ (full range)

Weekly rebalancing: r* = 1.5

Monthly rebalancing: r* = ∞ (full range)

LPs end up w/negative returns for this pool, but were raking in $ during the bull market (~40% returns in < 6 months)

For the 🐂 market (Jun 2021 - Mar 2022):

Daily rebalancing: r* = 1.5 - ∞

Weekly rebalancing: r* = 1.5

Monthly rebalancing: r* = 1.75

LPs end up positive! (~20% returns in 10 months)

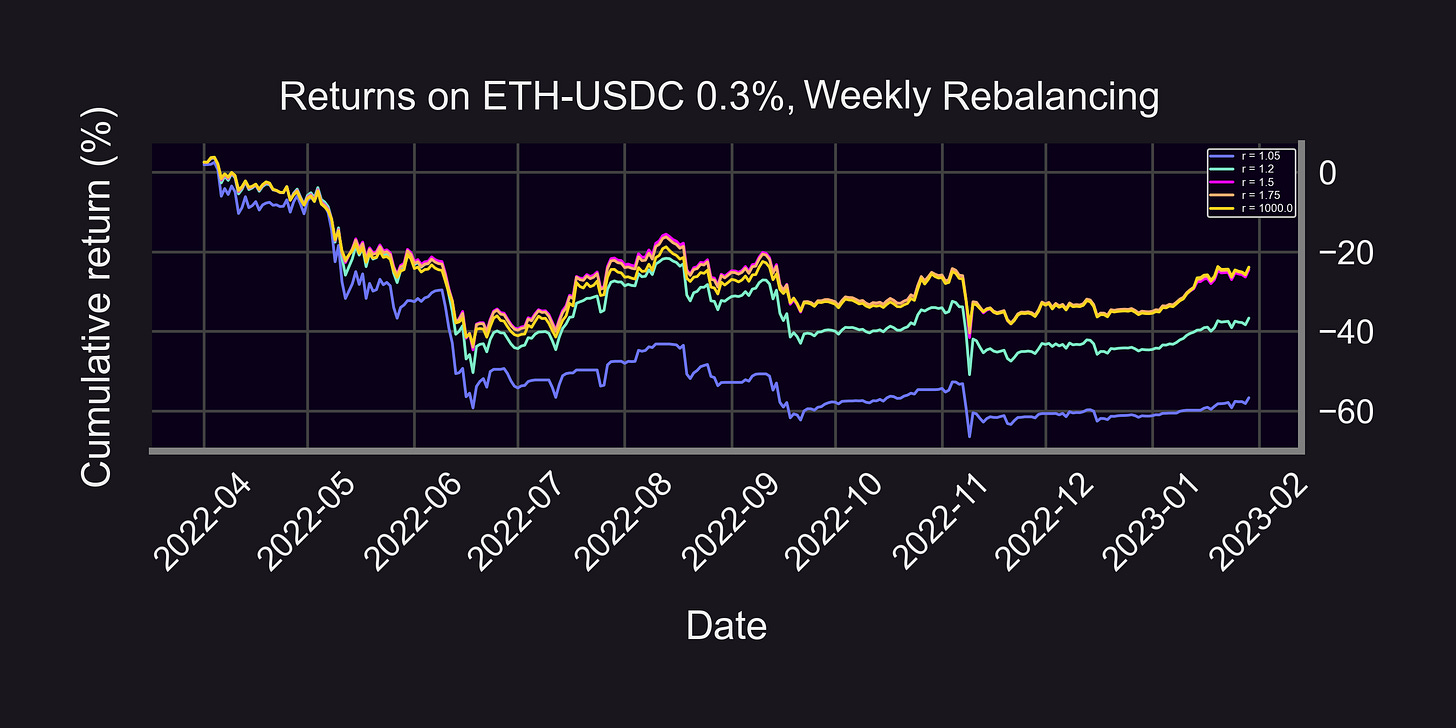

For the 🐻 market (Apr 2022 - Jan 2023):

Daily rebalancing: r* = ∞

Weekly rebalancing: r* = 1.75 - ∞

Monthly rebalancing: r* = ∞

LPs end up negative (-24% returns in 10 months, but compare that to -55% returns on ETH!)

During 🐂 market, optimal range was tighter (r = 1.5 - 1.75). But during 🐻 market, optimal range was wider (r = 1.75 - ∞). Here's why 👇

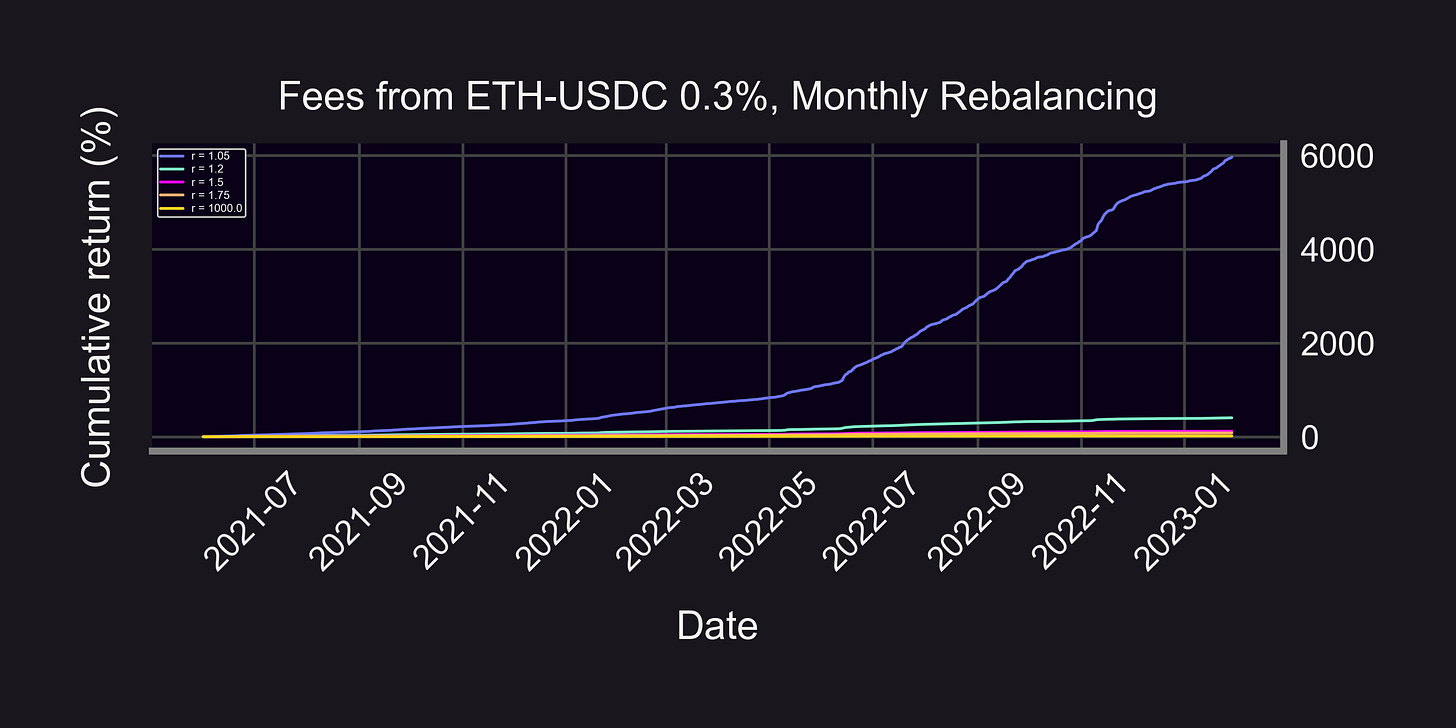

Tight range:

🤑 "Greedy"

🚀 More fees! (~6,000% cumulative fees in 1.5 years, r = 1.05)

💩 Buy losing asset faster, sell winning asset faster

Wide range:

🦺 "Safe"

🚀 Buy losing asset slower, sell winning asset slower

💩 Less fees (16% cumulative fees, r = ∞)

There's a tradeoff in choosing r:

⬆️ fees ⬇️ payoffs

or

⬇️ fees ⬆️ payoffs

@guil_lambert has a good "Guide For Choosing Optimal Uniswap V3 LP Positions" 👇

✅ Gives probability of landing ITM

❌ Doesn't account for where we land ITM

❌ Doesn't account for time spent ITM

Caveats:

⛽ Ignores gas & rebalancing fees

📈 Assumes fees/returns compound day-over-day

⚠️ Past performance is no guarantee of future results!

Questions:

🌊 What about other pools? (🦄, ₿, SHIB, ...)

⚖️ What about stablecoin pools?

Disclaimer:

📢 None of this should be taken as financial advice.

⚠️ Past performance is no guarantee of future results!