Maximizing Profits: Buying Put Options on 16 Uniswap Pools

What if you could buy puts by shorting LP positions?

Imagine a market that only lets you sell assets, never buy...Could you be profitable?

That market isn't imaginary. That market is...Uniswap Liquidity Providing!

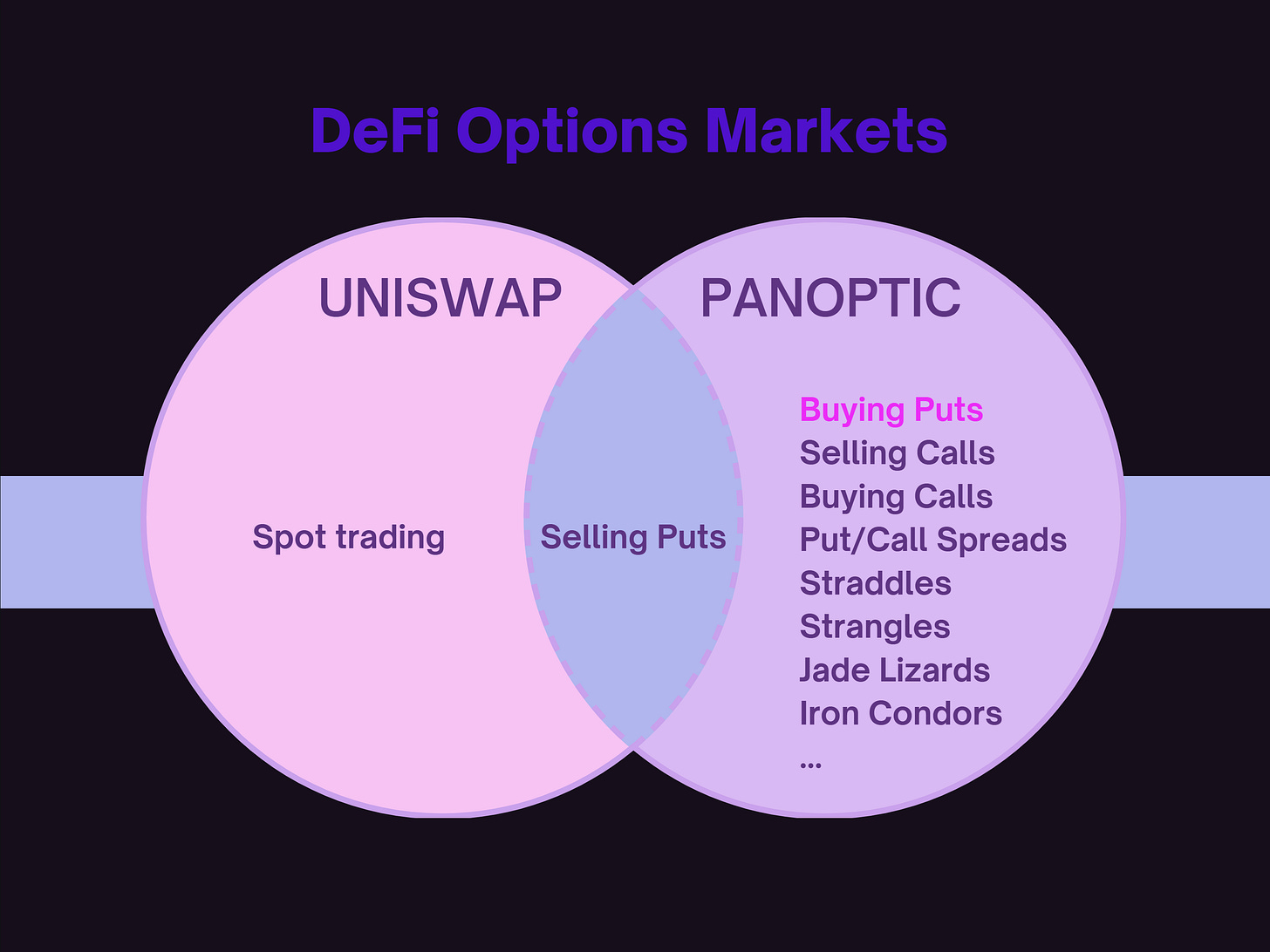

LPing = selling options, but what if users could SHORT LP tokens and effectively BUY options...?

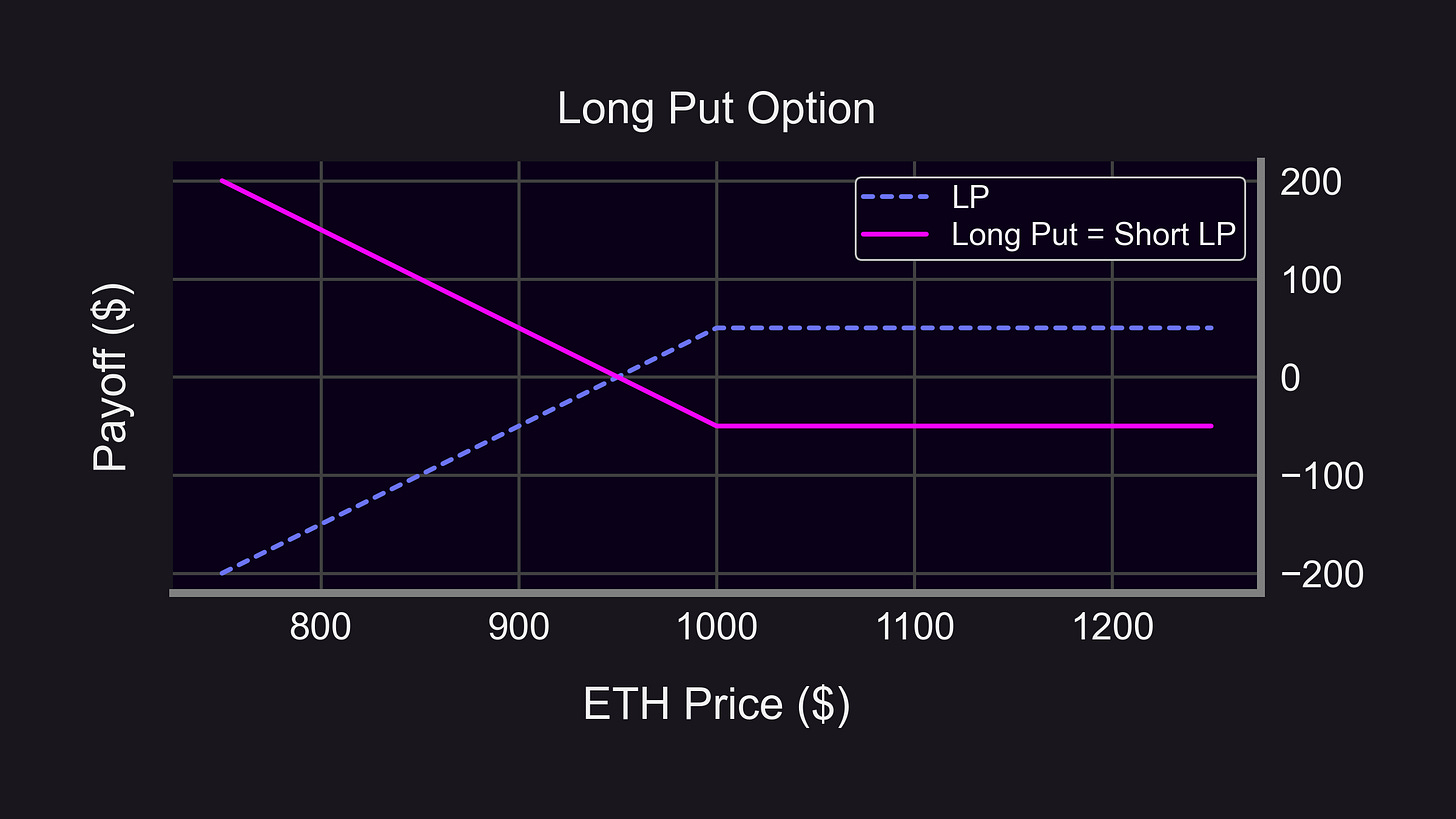

LP positions on Uni V3 mimic the payoff of selling put options. Uniswap users can only deposit liquidity and sell put options, which means they can only take a bullish position.

Token goes up, LP value goes up (but capped) 🚀

Token goes down, LP value goes down 😭

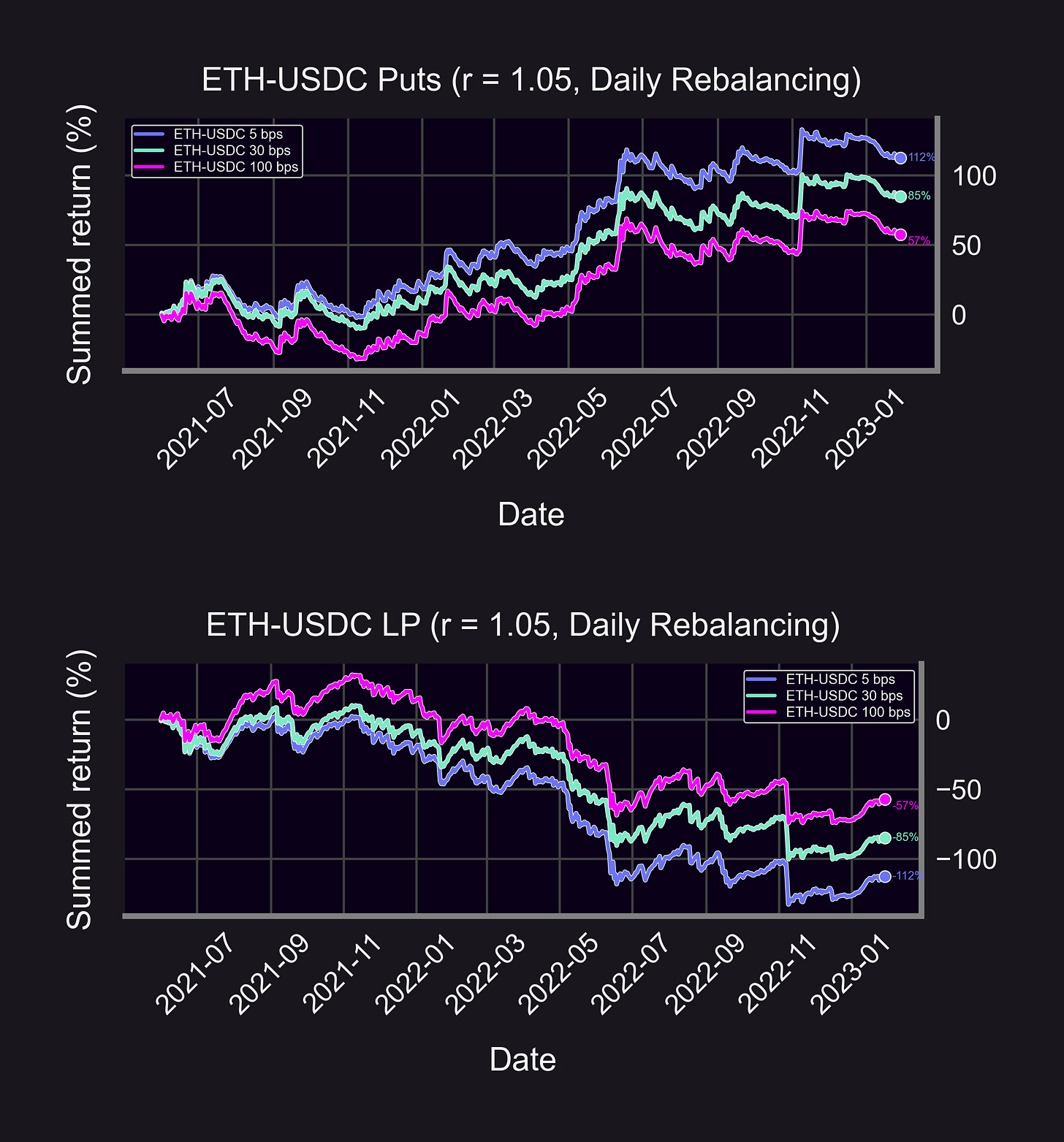

While selling options can be profitable, our backtests show that it wasn't always the case 👇

Is there a way to "short" an LP position and effectively *buy* a put option...?

We'll answer this... But first, let's simulate an options buying strategy!

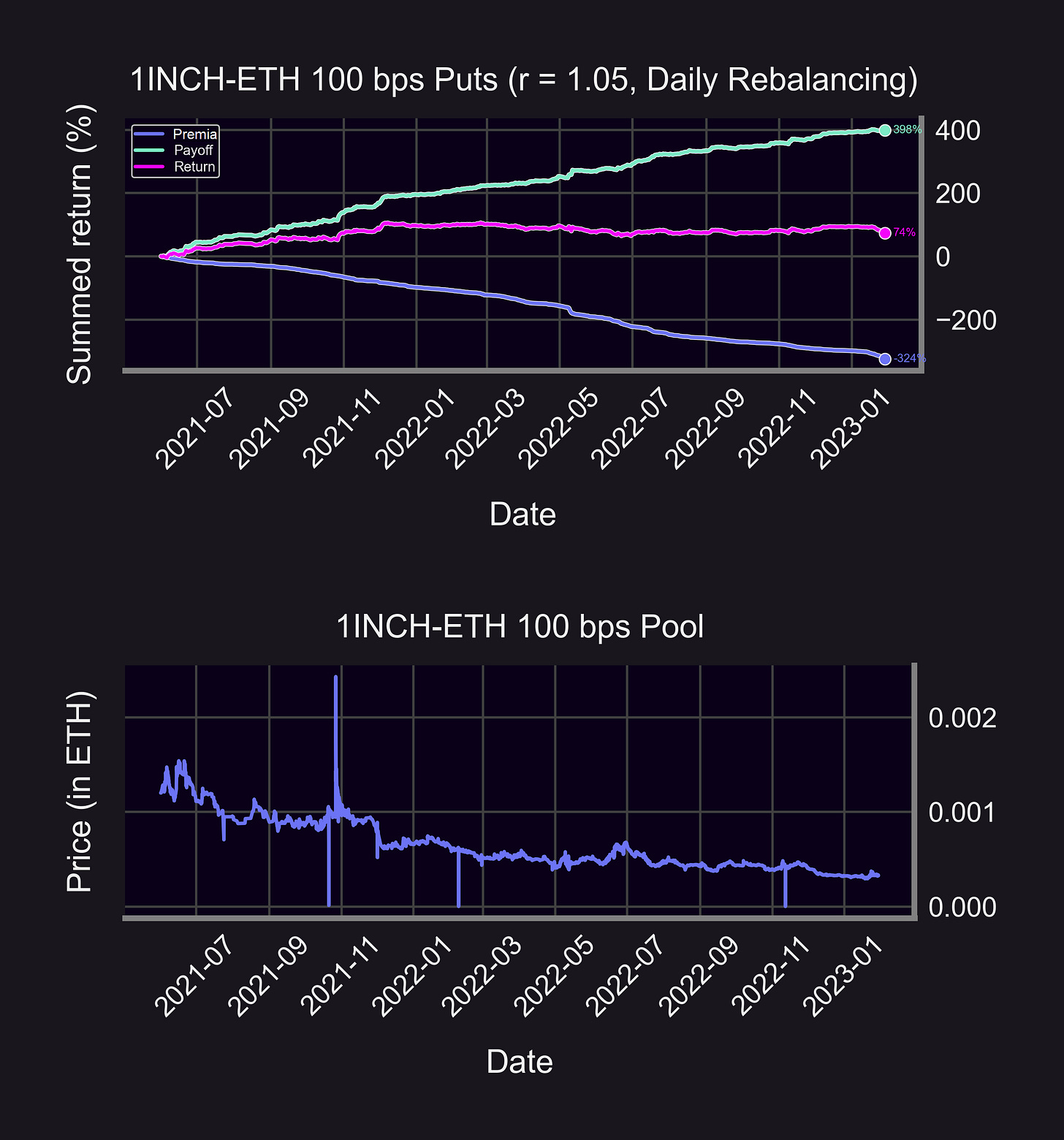

For this study:

🗓️ Jun 2021 - Jan 2023 (20 months) where applicable

⚖️ Daily rebalancing

📏 Narrow (r = 1.05) range ↔️ 0DTE

Daily strategy:

Buy ATM put option by shorting LP position

Exercise/close put option at end of day

Pay LP swap fees as premia

Returns on buying $ETH put options:

🌕 ETH-USDC (5bps): 112%

🚀 ETH-USDC (30bps): 85%

🧑🚀 ETH-USDC (100bps): 57% (Returns in USDC)

👉Put option returns are exactly opposite of LP returns👈

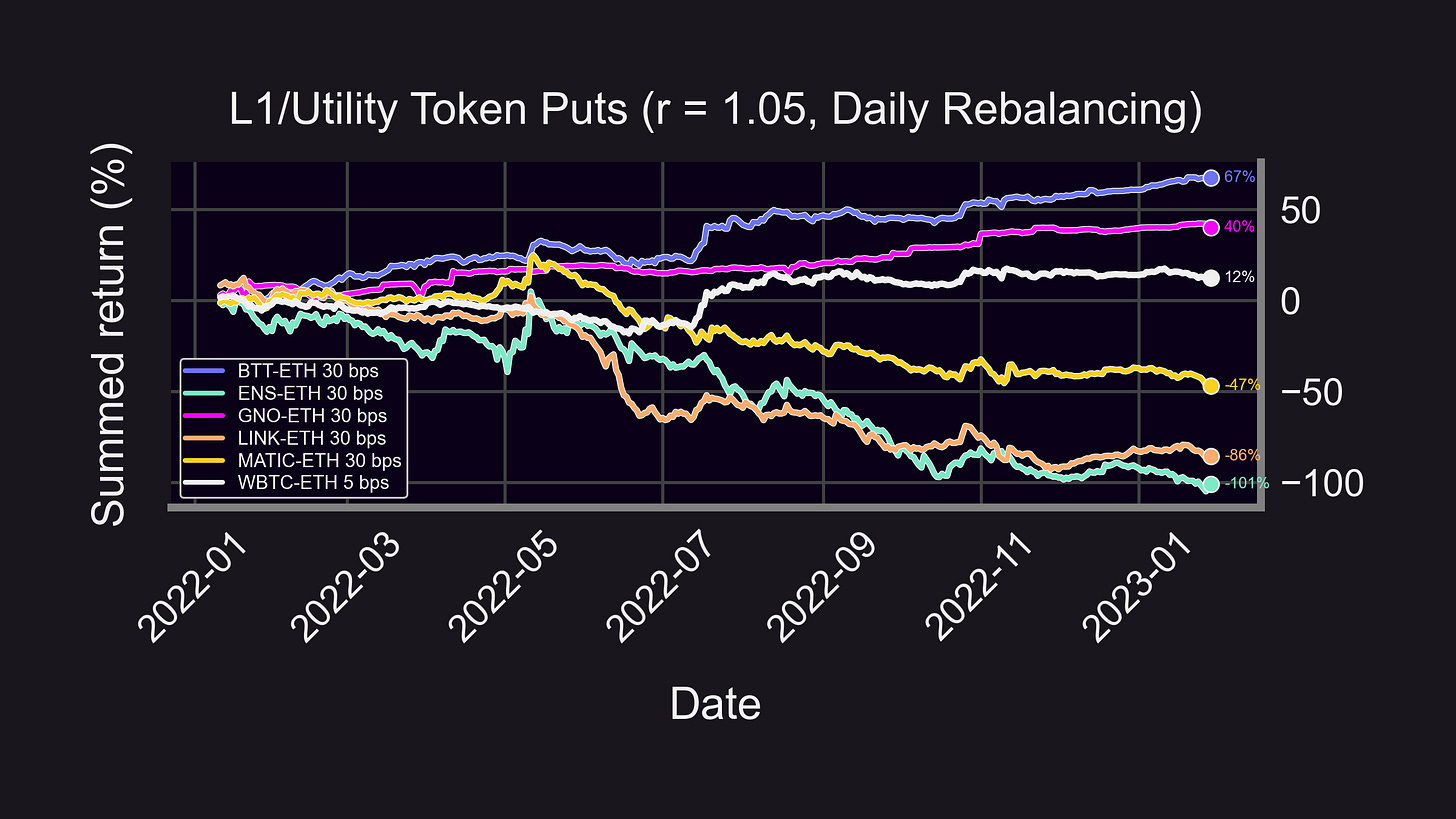

Buying "L1/Utility token" put options:

(Returns in ETH, see legend 👇 for pool details)

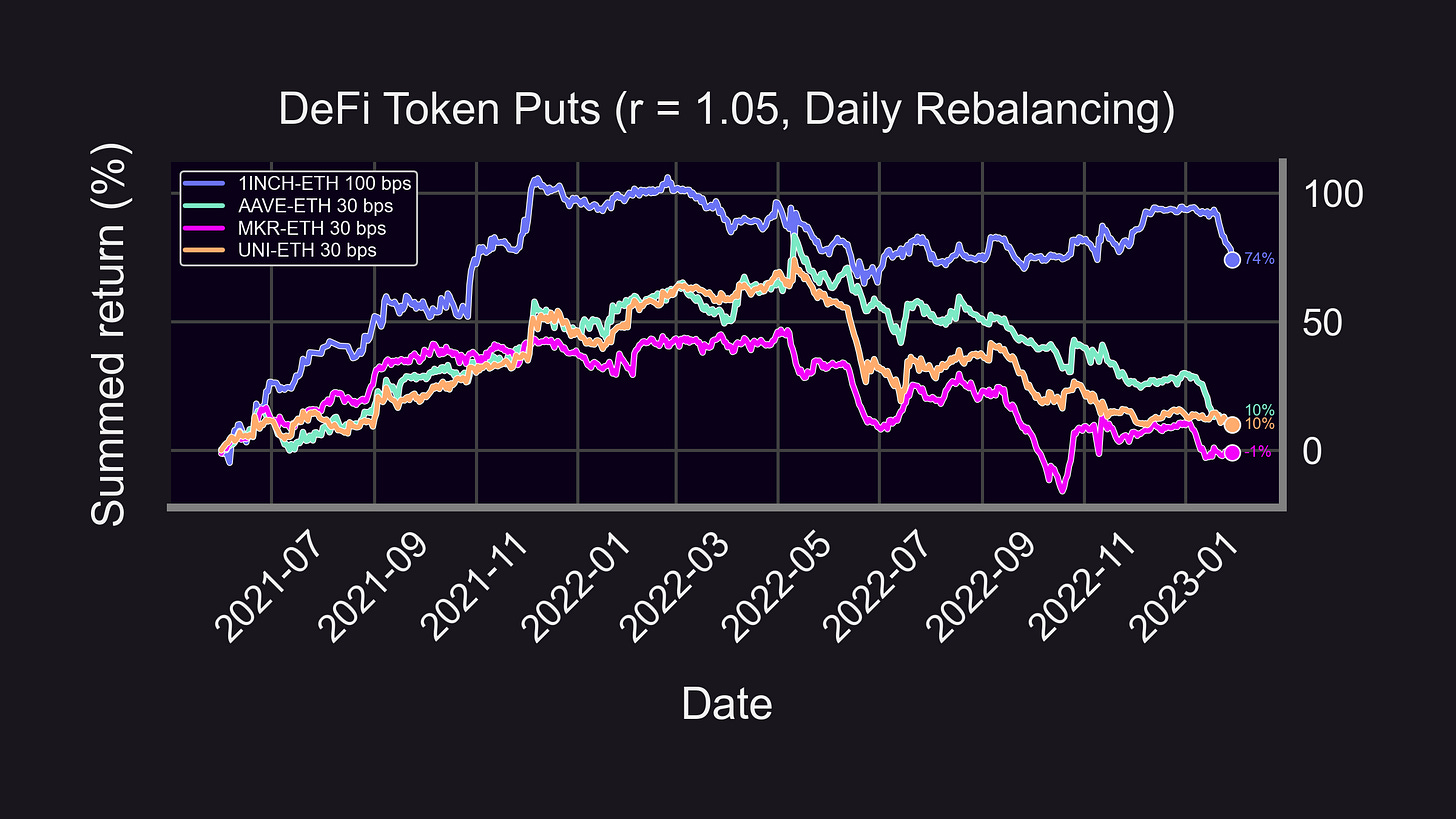

Buying "DeFi token" put options:

(Returns in ETH)

👉DeFi puts did pretty good!👈

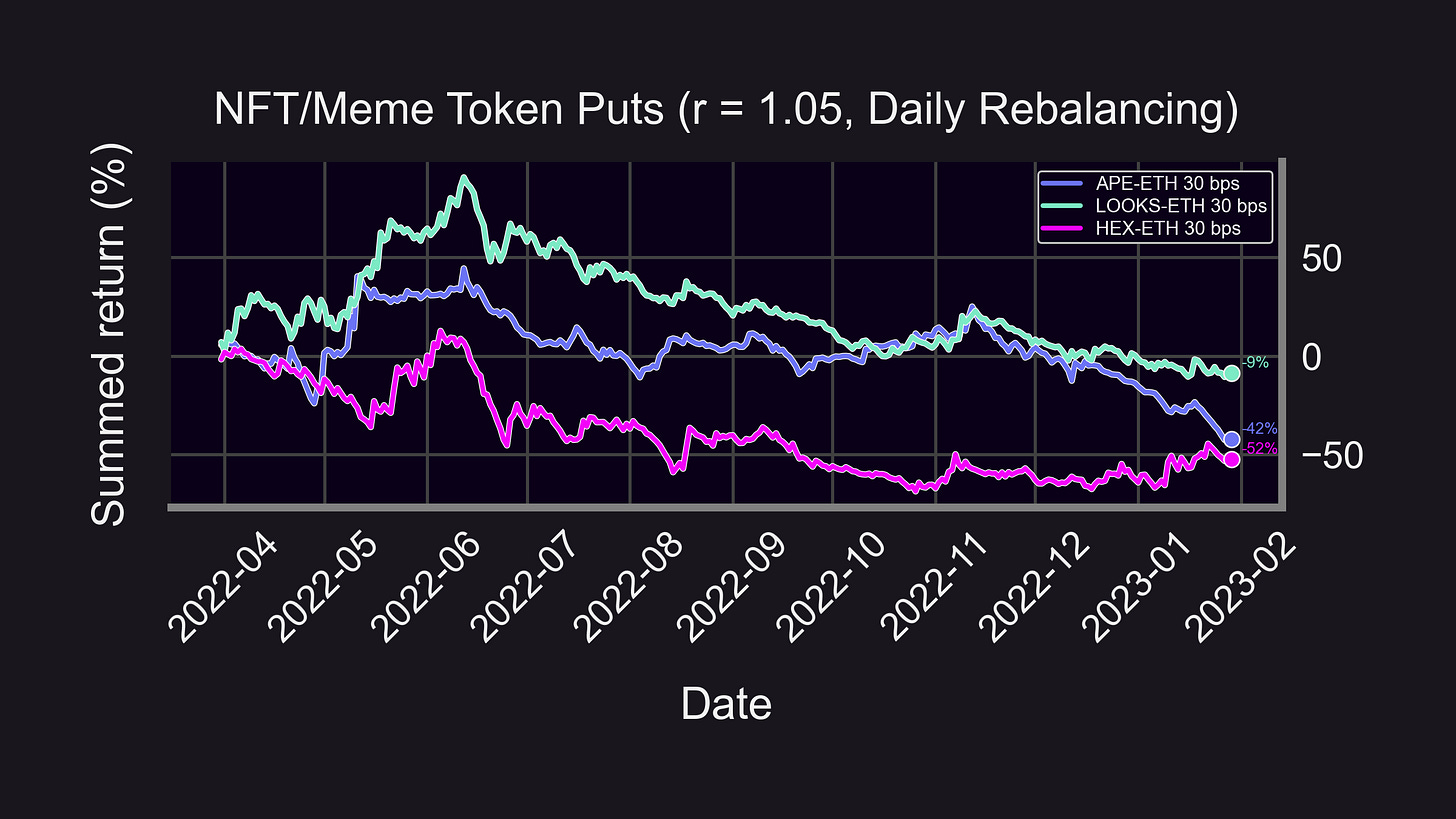

Buying "NFT/Meme token" put options:

(Returns in ETH)

👉Don't "put" ⤵️ down the meme tokens👈

Key Insights:

🐻 Bearish price action = high payoff

💰 Payoff > premia → profit!

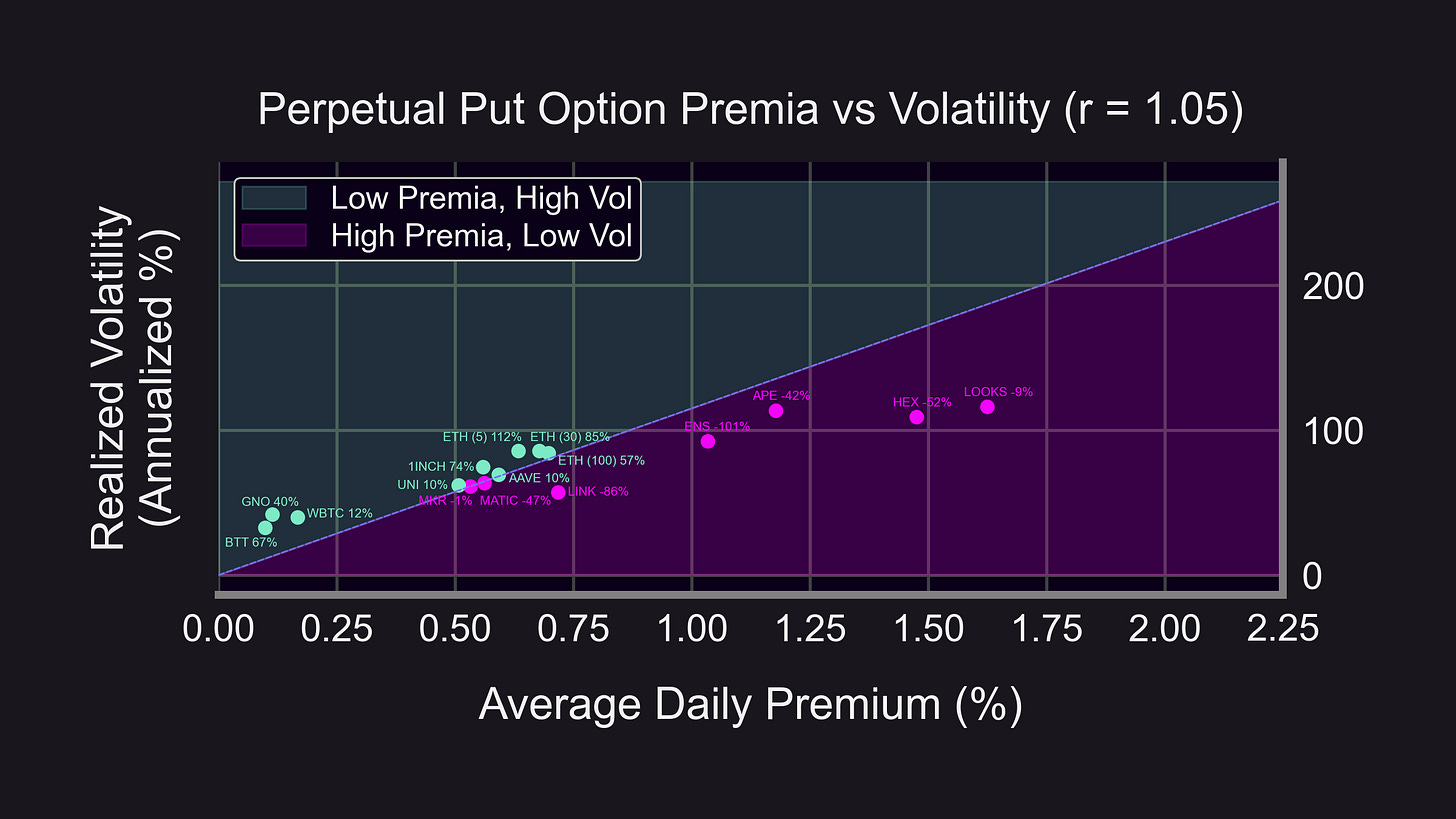

In TradFi, options buying is more profitable when Implied Volatility (IV) < Realized Volatility (RV). Do we see the same result here?

Instead of IV let's use the premia:

Easier to calculate 🧮

⬆️ IV ⇔ ⬆️ Premia

Graph below:

🐶 Outperforming puts (green dots): lie above the line, low premia given volatility ("IV < RV")

😈 Underperforming puts (pink dots): lie below the line, too expensive ("IV > RV")

Is there a way to "short" an LP position and, hence, *buy* a put option?

Enter @Panoptic_xyz!

Panoptic allows you to buy *and* sell DeFi options for any crypto asset, any strike, any size.

Caveats:

⛽ Ignores gas/spread/swap fees/commission

💲 Assumes put option premia = LP collected fees

❓ This is a "what if" scenario — you can't buy put options on Uniswap (yet)

Question:

⚖️ Are LP returns in disequilibrium?

(Future #ResearchBites 😉)

Disclaimer:

📢 None of this should be taken as financial advice.

⚠️ Past performance is no guarantee of future results!