Maximizing Profits: Naked Calls vs. Covered Calls

Backtesting what some consider the "riskiest" of strategies

🔥 If you're looking for a way to earn extra income, selling call options can be a powerful strategy. But beware: selling naked calls can be risky. Here's what you need to know:

💰 Selling call options gives you the ability to earn premium income. But if you sell a naked (unhedged) call, you're taking on unlimited risk since you're obligated to sell the underlying asset at a preferential price if the buyer exercises the option.

🤔 So what's the alternative? You can sell covered calls, which involves selling call options on an asset you already own. In TradFi, this is considered "safer" since:

Downside is NOT unlimited (but still substantial)

Markets tend to go up (this is a bullish strategy)

The payoff of selling a covered call is the same as a naked put. (Bonus point: covered call = naked put = Uniswap LP 🤯)

🔍 To figure out which strategy is right for you, it's important to backtest and analyze past data. Let's analyze what periodically *selling* naked ATM ETH calls over the last 2 years might look like!

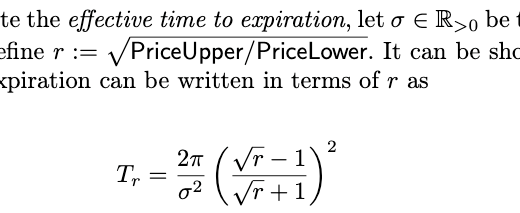

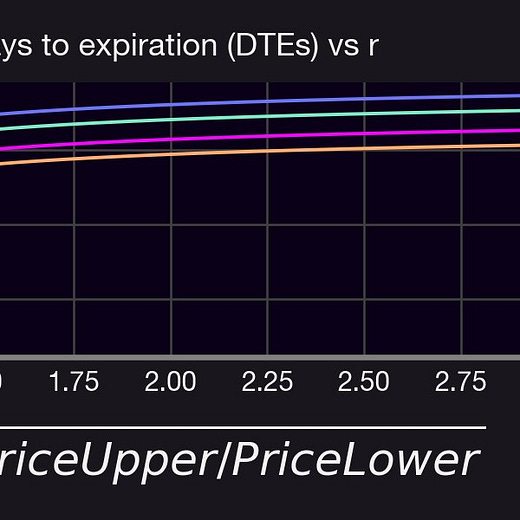

Anyone will be able to sell options on Panoptic for any asset at any strike. Panoptic options even have an "effective Time To Expiration"👇 This means you can customize your Panoption to sell "dailies", "weeklies", and "monthlies". Let's backtest these 3 strategies!

Backtest #1: selling (naked) calls on $ETH every week.

Earned 126% in premia

Lost 132% from calls being exercised

→ Total PnL: -6%

(Compare to ETH HODL: -32%)

Unfortunately, our strategy wasn't profitable. What if we tried different rebalancing periods?

Backtest #2: selling (naked) calls on $ETH every day/week/month.

Weeklies: -6%

Monthlies: -28%

Dailies: -57%

Wow...dailies & monthlies did even worse. Let's try something typically seen as "less risky" — covered calls!

Backtest #3: naked calls vs. covered calls.

Naked calls: -6%

Covered calls: +6%

(The fact that they are exactly opposite is a coincidence.)

Covered calls did better...but why?

Notice how naked calls (blue curve) performed great in May 2022 — during the Terra collapse and bear market!

Fact:

Bull market → naked calls 👎

Bear market → naked calls 🚀

Let's test this out on one of the biggest bear markets: the UNI-ETH price!

In the spot markets, UNI has massively underperformed ETH. That makes the UNI-ETH price a bear market. So what happens if you sell naked calls on UNI-ETH? Answer:

😎 Dailies: +55%

😄 Weeklies: +54%

🙂 Monthlies: +38%

Summary:

Naked calls have unlimited risk

Naked calls are bearish and do well in 🐻 markets

Covered calls are bullish and do well in 🐂 markets

Caveats:

⛽ Ignores gas/swap fees/commission

💲 Assumes premia = LP fees

❓ This is hypothetical — you can't sell calls on Uniswap (Panoptic soon 🤫)

Disclaimer:

📢 None of this should be taken as financial advice.

⚠️ Past performance is no guarantee of future results!