How to hedge ANYTHING (including UniV3 LP positions) with options

A tutorial on hedging payoffs using options

How to hedge ANYTHING (including UniV3 LP positions) with options 👇

Why options?

Flexibility: Construct any payoff curve

Greater protection: hedge against price going up AND down

Capital efficiency: Low upfront cost for OTM puts/calls

Let's construct a hedge!

First, identify your strategy's position.

Assume initial ETH price is $1,000. Let's start with 1,000 USDC.

We sell 50% of that for ETH:

x0 = 0.5 ETH

y0 = 500 USDC

We LP 0.5 ETH & 500 USDC in the ETH-USDC pool.

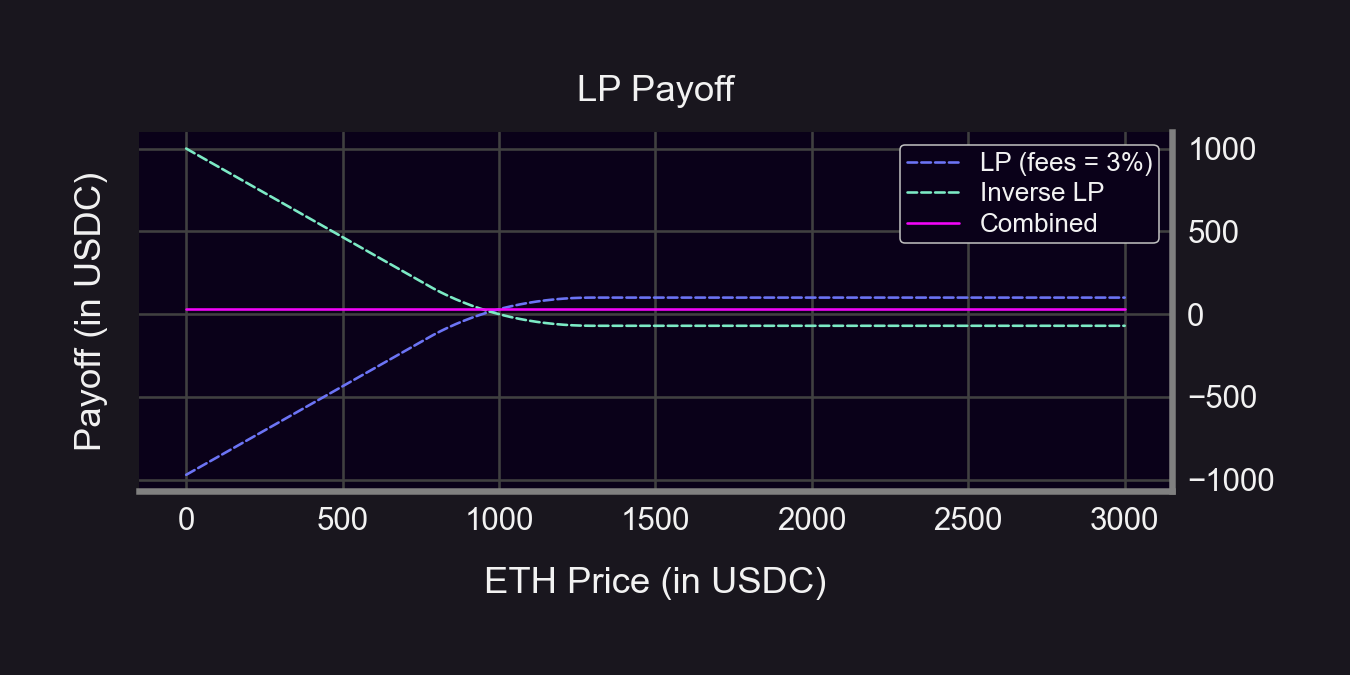

Second, calculate the payoff curve for your strategy's position.

UniV2 LP value: V = 2L√S + fees

S = (Spot) price of ETH

L = √(x0 * y0)

Subtract our initial capital:

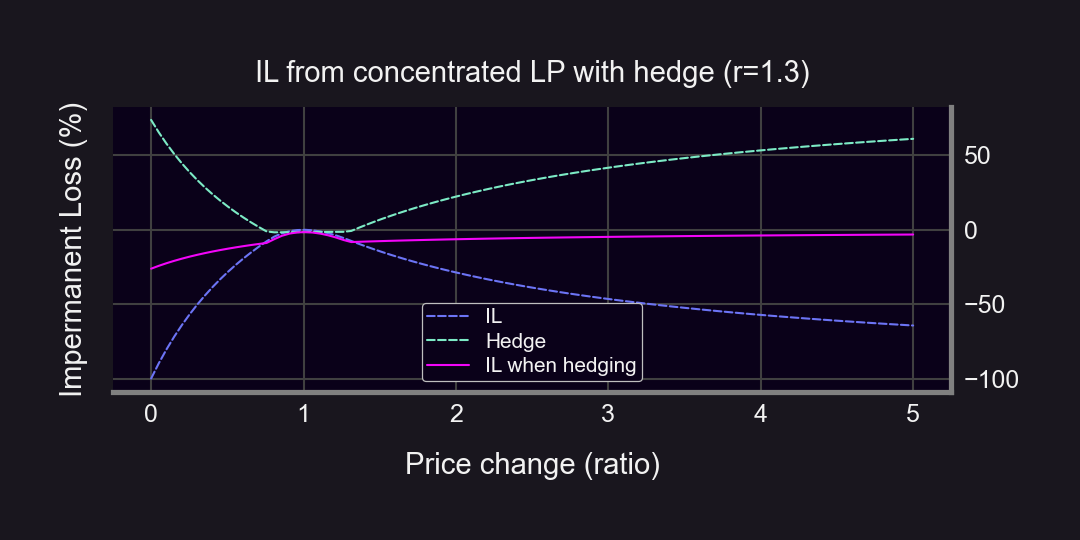

And for UniV3...

A *bit* more complicated than UniV2

Formula (while in range) by @guil_lambert here

Example: r = 1.3 → ±30% LP range (see 🧵 for why)

Third, find an "inverted" payoff curve.

You want to hold a portfolio that pays the opposite. So just flip the payoff curve on its head.

The goal is to #FlattenTheCurve into the pinkish line.

Example when r = 1.3 👇

Fourth, construct a portfolio replicating the inverse curve as closely as possible.

A long put option is a natural choice here since it benefits from $ movements down.

Finally, let's put them together. Buy the hedge portfolio and hold it with your original position!

Assumptions:

Initial ETH price = $1,000

Long 1 ATM Put (strike = $1,000, DTE = 10)

Put premium = $50

LP fees = 3% (r = 1.3 ⇔ DTE ≈ 10)

How'd we do?

S < $1,000: hedged payoff is flatter (and positive at times!)

S >= $1,000: hedged payoff is lower (due to premium)

Hedging always costs $. We need to earn enough fees to cover the hedge price.

To summarize:

Understand how your position reacts to price changes

Find an opposite reaction

Figure out what assets you can hold to mimic the opposite reaction (this is your hedge!)

Buy the hedge (with Panoptic😉)!

Take comfort knowing you're protected🛡️

What about impermanent loss (IL)?

Notice we started with 100% of our capital in USDC.

HODL portfolio of 100% USDC doesn't fluctuate

→ We already accounted for IL against a 100% USDC portfolio

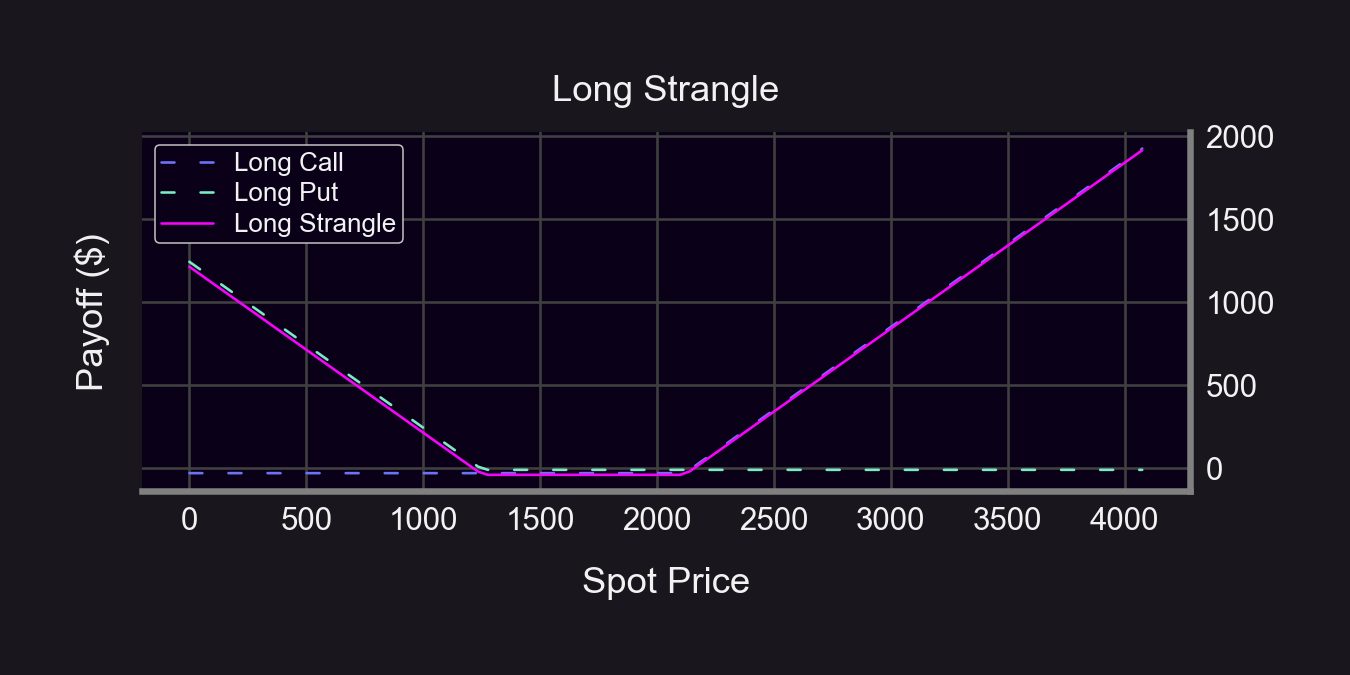

But if we define IL against a 50/50 ETH-USDC HODL, we can hedge with a strangle:

What about hedging with perps?

Pros:

More liquid

More asset listings

Static delta (no gamma!)

Cons:

Less flexible: can only short/long at current contract price

Pay funding rate (if on the "wrong" side)

Static delta (no gamma...)

What about hedging with Squeeth?

Pros:

More liquid

Able to completely hedge delta/gamma

Cons:

Only works for ETH-stablecoin pools

High funding rates

What are the drawbacks to using options?

Listings: no long-tailed assets on Deribit/OKX/Binance (just ETH/BTC)

Illiquidity: lower liquidity on deep OTM options

High maintenance: options expire + time decay

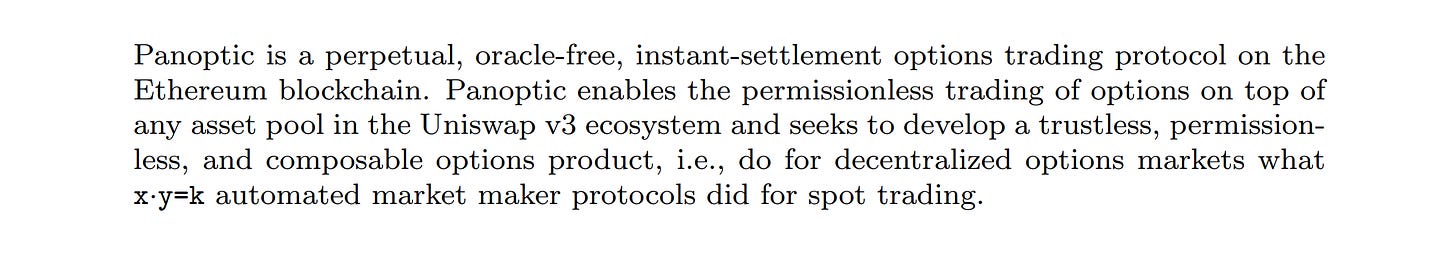

Panoptic solves this! Here's how 👇

Panoptic is permissionless:

Listings: Permissionless pool creation on top of UniV3

Liquidity: Permissionless LP for options at any strike price

No expiry: XPOs are non-expiring, perpetual options

Read the whitepaper here.

Insights:

LP positions look like short puts → LPers are selling options

Only way to fully hedge an LP position is to short it

Only Panoptic enables shorting LP positions (any asset, any strike)!

Broke: Hedging with expiring options

Woke: Hedging with Panoptic XPOs

Disclaimer: This content is for educational purposes only and should not be relied upon as financial advice. Please DYOR!