8 Reasons Why Concentrated Liquidity (and Panoptic) is the FUTURE

Why CLMMs supersede AMMs, and why Panoptic is built on concentrated liquidity...

🌊 Uniswap v3's business license expired on April 1st, sparking a massive wave of interest in Concentrated Liquidity Market Makers (CLMM).

Here's 8 reasons why concentrated liquidity (and Panoptic!) is the FUTURE of DeFi 🛥️🚀!

🍴 Reason #1: New CLMMs everywhere

The OGs:

Uniswap v3

Kyber Elastic

Trader Joe v2

Uni v3 forks:

PancakeSwap v3

SushiSwap v3

Quickswap v3

Camelot v3

ApeSwap v3

MaiaDAOEco

Panoptic can integrate all CLMMs! (Panoptic v2...😉)

See this thread to learn more about Uniswap’s business license and forks

📈 Reason #2: CLMM traction is unstoppable

The majority of DEX trading volume is on CLMMs. Out of the $87 bn traded on DEXs last month, $49 bn was on CLMMs (56%)!

CLMMs' capital efficiency provides better slippage, making it a popular choice for traders and aggregators.

The trend is CLMM's friend:

Nearly a fifth of TVL on DEXes belongs to CLMMs (18%). That's up from ~7% a year prior! 🚀📊

Interesting how < 1/5 of TVL is supporting > 50% of DEX volume...that's capital efficiency! 🤯

🎯 Reason #3: CLMMs are capital efficient

CLMMs allow liquidity providers to concentrate their funds within specific price ranges. This maximizes potential returns, minimizes idle capital, and reduces slippage for traders!

🙆 Reason #4: CLMMs are flexible.

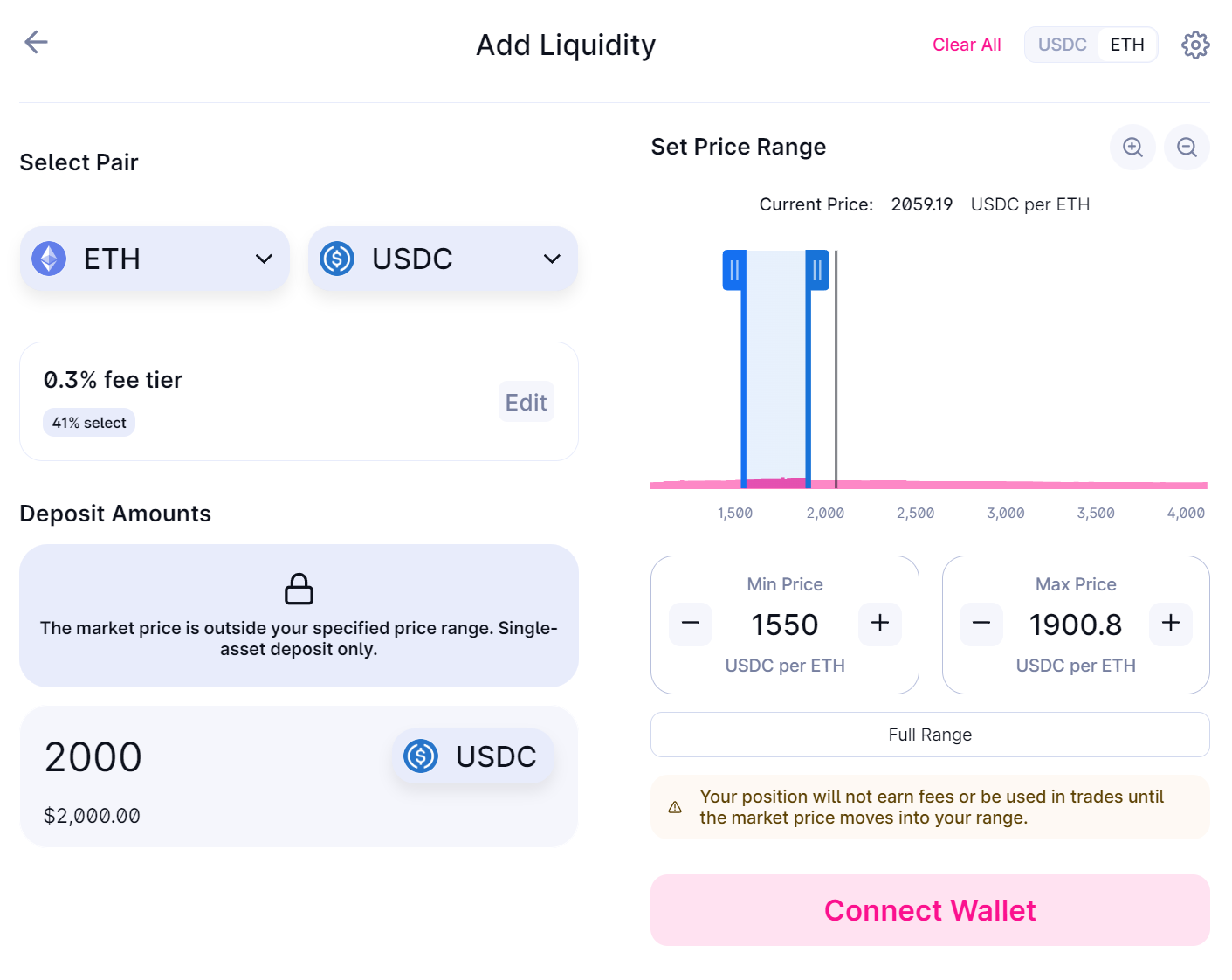

CLMMs let LPs set their preferred price range. They can choose between tight/narrow ranges that are above/below/straddle the current price.

In fact, LPs can still choose to provide full-range liquidity on a CLMM just as they do on regular AMMs!

(See this thread for more on choosing a price range)

🏪 Reason #5: CLMMs are convenient for Liquidity Providers (LPs)

CLMMs let LPs provide single-sided liquidity:

For example, in ETH-USDC, LPs can deposit ETH in any price range above the current price or deposit USDC in any price range below the current price.

🔓 Reason #6: CLMMs enables option payoffs

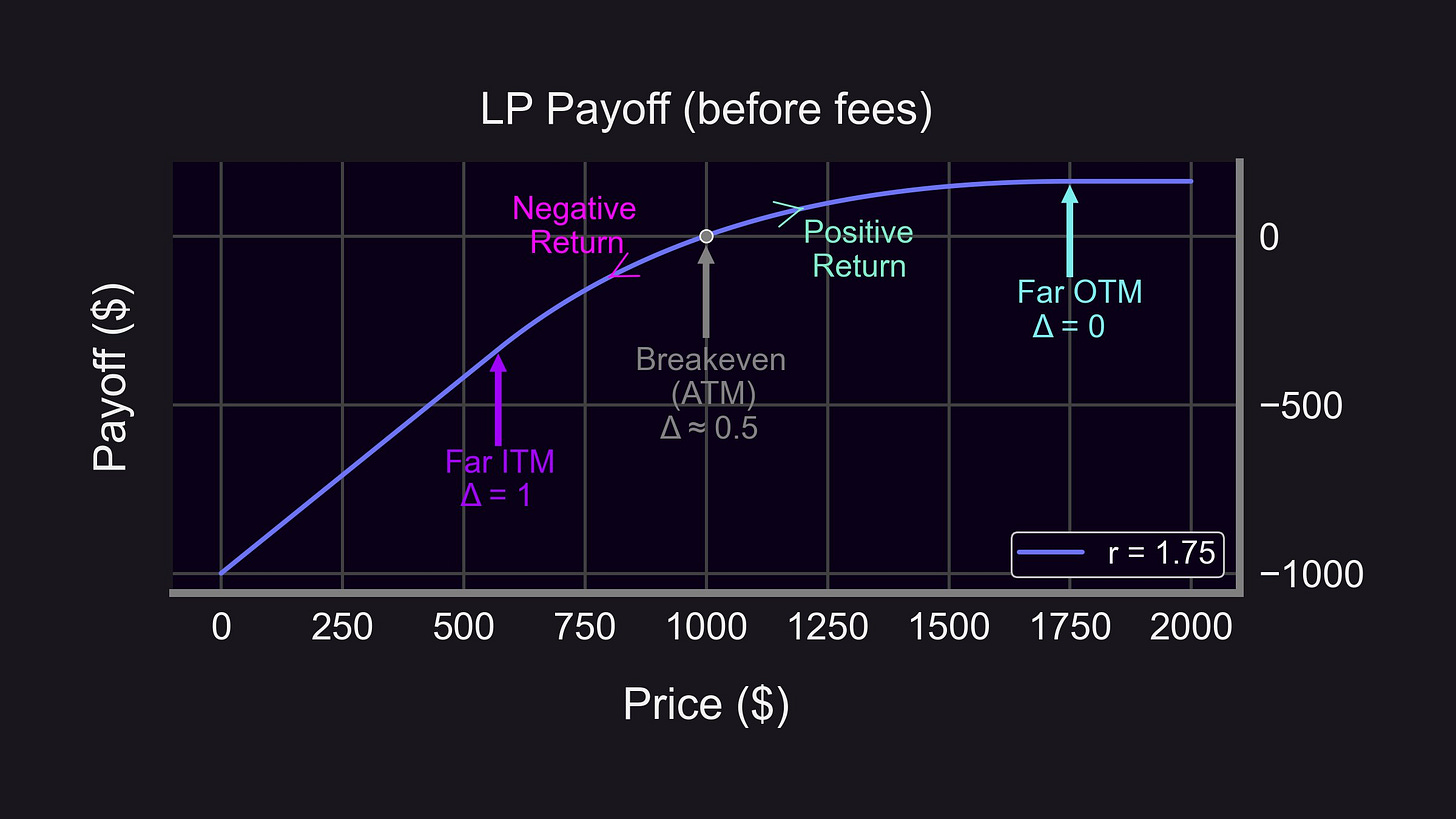

Concentrated liquidity allows Panoptic to provide true options payoffs (i.e. put and call options).

If you set your LP range to be extremely narrow, the payoff looks exactly like a short put option! 🤯

(See this thread for more)

🫶 Reason #7: CLMMs offer customizable strike prices

Concentrated liquidity allows Panoptic to create in-the-money, out-the-money, and at-the-money puts and calls at any strike price!

The "middle" part of the LP range is the strike price.

(by "middle" we mean geometric average)

🧩 Reason #8: CLMMs use financial NFTs

CLMMs use NFTs to represent unique LP positions.

Panoptic uses ERC1155s to aggregate options positions enabling composability!

ERC1155s allows for multi-legged, capital-efficient, and gas-efficient options (future #ResearchBites 😉)

(See this thread for more info on why Uniswap represents LP tokens as NFTs)

In summary, CLMMs are efficient, flexible, and are here to stay.

Panoptic is leading the DeFi options space by leveraging the power of CLMMs with innovative features like options payoffs, customizable strike prices, multi-legged minting, and capital efficiency! 🚀🌐📈